Full-Service Tax Preparation

in El Sobrante.

We offer our services in both English and Spanish to help you succeed on all fronts.

Baywise is your all-in-one solution for financial and business growth in El Sobrante and the Bay Area. We provide expert tax preparation to maximize your refund, organized bookkeeping to clarify your finances, and powerful digital marketing strategies to attract new customers. We help you succeed on all fronts.

Si está buscando expertos en preparación de impuestos en El Sobrante, llámenos ahora.

Financial Expertise & Strategic Guidance

Tailored Solutions & Personalized Support

Proactive Approach & Future-Focused Planning

Baywise

Professional Tax Preparation Services and More in El Sobrante

Professional Tax Preparation

We provide expert tax preparation services tailored to individuals, families, and small businesses. Our team helps you file accurately, find savings, and stay compliant with all tax laws. We maximize your refund and ensure complete accuracy.

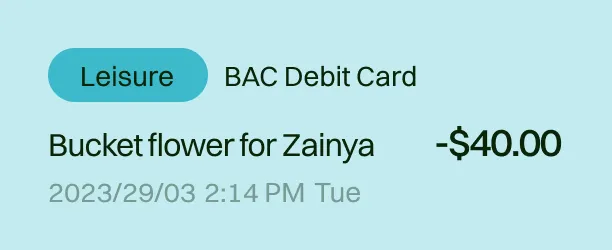

Bookkeeping Services

We organize your financial records with precision. We track income, expenses, and provide clear reports, so you always know where your business stands. We help you make smarter business decisions throughout the year.

Digital Marketing Services

We help local businesses grow with smart and effective digital marketing. From SEO and social media to online ads and content, we create strategies that bring real results. Reach more customers and build your brand with our expert support.

Baywise

Still Owe Taxes from Previous Years?

We Help You File Your Taxes Accurately and On Time

Have you missed filing taxes in the past? Still getting letters from the IRS or the State of California? Unsure how much you owe or how to fix it?

Many people fall behind on income taxes, self-employment taxes, payroll taxes, or sales taxes. Life gets busy, laws change, and paperwork piles up. But the longer you wait, the harder it gets. We’re local tax consultants in El Sobrante, helping individuals and small businesses across California and the Bay Area.

We check what you owe, file everything correctly, and speak to the IRS or state if needed. We guide you through every form, deadline, and detail. At Baywise, we keep your finances in order. Whether it’s one year or several, we handle it all with care.

Why Accurate Tax Preparation Matters More Than Ever

Tax rules change often. If you miss an update, you could face delays, penalties, or even an audit. That’s why now, more than ever, being accurate with your taxes isn’t just smart, it’s necessary.

Today, many people have side jobs, investments, or small businesses. Your taxes may be more complex than you think. One small mistake can lead to problems, lost money, or unnecessary worry. When your tax return is done right, you avoid errors, get your refund faster, and reduce your risk of issues with the IRS. You also make sure you’re not missing out on valuable credits or deductions that could save you hundreds or more.

Baywise helps you file with confidence. We stay up to date on the latest tax laws and take time to understand your unique situation. Whether you’re an individual, a family, or a small business, we make sure your taxes are clear, accurate, and on time.

Baywise

Bookkeeping Services for Small and Medium-Sized Businesses in El Sobrante

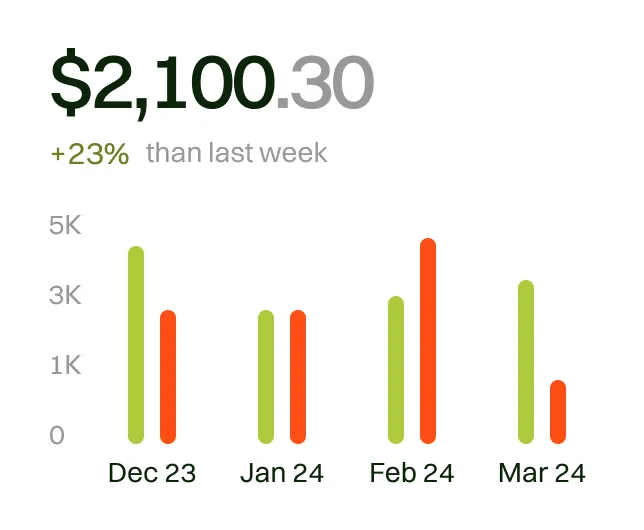

Running a small or medium-sized business comes with a lot of moving parts. Between managing customers, handling staff, and growing your brand, keeping up with your books can fall to the bottom of the list. But without accurate financial records, you risk cash flow issues, tax problems, and missed growth opportunities.

Many business owners try to do it all and end up feeling swamped. Spreadsheets pile up, receipts get lost, and important reports are never ready when you need them.

At Baywise, we work with local businesses right here in El Sobrante to keep financial records clean, current, and easy to understand. Whether you’re just starting or managing a growing team, we customize our bookkeeper services to fit your needs. You’ll always know where your money is going, what’s coming in, and how your business is really performing. We offer small business bookkeeping to keep their financial records accurate and up to date. Our bookkeeping and payroll services help them manage their expenses and pay team on time, every time.

Want to stop worrying about your books and start making smarter business decisions? Contact Baywise today!

Book Your Tax Consultation

Book Your Tax ConsultationBaywise

We Handle IRS Correspondence So You Don’t Have To

Got a letter from the IRS and not sure what it means? Most people feel confused or even anxious when that envelope shows up. The wording is complicated, the deadlines are strict, and the stakes can feel high, even if it’s just a small issue.

You might worry you’ll say the wrong thing…or worse, not respond in time. Ignoring it isn’t safe, but doing it on your own adds unnecessary pressure.

Baywise takes over the back-and-forth with the IRS, so you don’t have to deal with the worry or confusion. We review the letter, explain what it means in simple terms, and respond correctly on your behalf. Whether it’s about a missing document, a tax balance, or something more complex, we know how to handle it. We make sure everything is done properly and on time! Contact Baywise now for tax preparation in El Sobrante.

Baywise

Local El Sobrante Tax Experts Who Know California Law

California’s tax rules update regularly, which can make them difficult to follow. As local tax professionals in El Sobrante, Baywise understands these laws inside and out. We help you follow the rules and find every possible credit and deduction to save you money.

California has unique tax requirements that differ from federal rules. Missing details can lead to penalties or lost opportunities. At Baywise, we stay up to date on state and local tax changes, so you don’t have to worry about compliance or surprises.

We are more than just tax consultants. We are also a trusted digital marketing agency. We help local businesses grow their presence online while managing their tax and financial needs with accuracy and care. When you work with Baywise, you get a team that knows El Sobrante and California taxes well. We provide clear advice, personal support, and smart solutions tailored to your needs for tax preparation in El Sobrante.

Customer Reviews

Discover what our clients think about our service

Baywise

Remote and Virtual Tax Prep Options Available

We provide expert tax preparation services in both English and Spanish, offering you the flexibility of in-person, remote, or virtual appointments to best fit your life. You can handle everything securely from your home or office using our simple and safe technology. We give you the same detailed, personalized care in every meeting, whether we connect online or in our El Sobrante office. Our team ensures you feel comfortable and fully understood in the language you prefer.

Schedule your appointment with Baywise today, in your preferred language and style.

Baywise

Benefits of Hiring Local Tax Preparer in El Sobrante, CA

Working with a tax preparer makes your life easier during tax time. You get personal help from someone who knows your area and understands California tax rules. You can talk face-to-face, ask questions, and get clear answers. A local tax professional helps you avoid mistakes and saves you time.

We maximize your refund by finding every deduction and credit you deserve.

We save you valuable time by handling all the complex paperwork for you.

We prevent costly errors to ensure your return is accurate and complete.

We offer year-round support and answer your questions anytime.

We give personalized advice that is tailored to your financial situation.

We build a trusted relationship with you as a neighbor who knows your name.

FAQs

Frequently Asked Questions

What’s the Penalty for Filing Late in California?

If you file late, the Franchise Tax Board (FTB) charges 5% of the unpaid tax per month, up to a maximum of 25%. Interest also applies. Filing on time, even without full payment, helps you avoid larger penalties.

Do I still need to file a California return if I already filed federal taxes?

Yes. California requires its own state tax return (Form 540). Filing your federal return does not automatically file your California return.

When is the California state tax deadline?

The deadline is usually April 15, the same as the federal deadline. If it falls on a weekend or holiday, it moves to the next business day.

Do I have to pay taxes if I’m self-employed in California?

Yes. You must report all income and pay state income tax and self-employment tax. You may also need to make estimated quarterly payments.

What documents do I need to file my California state taxes?

You’ll need W-2s, 1099s, records of deductions, business income/expenses, and your federal return, which California uses as a starting point.